Understanding Carbon Footprint in Purchasing

In today’s business environment, sustainability objectives are increasing as focal points for many companies. A key component of this is understanding the concept of a company’s carbon footprint and the implications for purchasing functions. Initially, I had little knowledge on this subject, so I enrolled in a course on Scope 3 emissions from the Greenhouse Gas Protocol. While I still consider myself a novice, I now recognize the significant impact carbon footprint considerations can have on purchasing activities, including spend data analysis, supplier selection, and price negotiations. Let's delve into the concept of the carbon footprint.

Carbon Footprint

The primary aim of carbon emissions reduction is to mitigate the adverse effects of climate change by reducing the amount of greenhouse gases (GHGs) released into the atmosphere. GHGs, such as carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O), trap heat within the Earth’s atmosphere, leading to global warming and climate change. A carbon footprint is a calculated measure of how much GHGs an activity, product, company, or country release into the atmosphere — typically expressed in terms of CO2 emissions. CO2 equivalents (CO2e) is the calculation of other gases in terms of CO2: Methane is 0.85 kg of CO2; Nitrous Oxide is 298 kg of CO2.

The Regulatory Landscape

In the United States, although there is no federal mandate, the Securities and Exchange Commission (SEC) has introduced new rules requiring public companies to disclose their Scope 1&2 GHGs emissions, with filings expected in 2026. The SEC has also proposed rules for Scope 3 emissions, which would require disclosure if these emissions are deemed material or if the company has made specific public commitments to reducing them by 2026.

In Europe, the regulatory environment is more stringent. The Non-Financial Reporting Directive (NFRD) requires large public-interest entities (those with over 500 employees) to disclose information on environmental matters, including GHG emissions. Starting in 2025, large companies, including non-EU companies with significant operations in the EU, will be required to report their GHG emissions.

Additionally, the European Union Emissions Trading System (EU ETS) imposes an allowance on GHG emissions, and companies exceeding this allowance must purchase additional credits. Conversely, companies with a favorable CO2 balance can sell their excess allowances.

The average price of carbon allowances in the EU ETS is currently around €65 per metric ton of CO2e, with projections suggesting this could rise to nearly €150 per metric ton by the end of the decade.

Scopes 1, 2, and 3

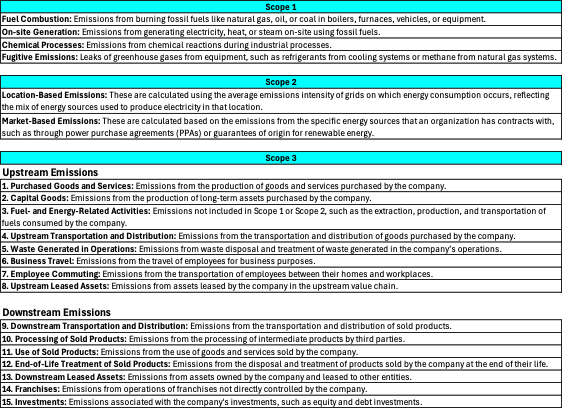

The Corporate Emissions calculated for a company are the sum of Scopes 1, 2, and 3. Below is a clarification of the different scopes of emissions.

Scope 1: Direct GHG emissions from a company’s own operations.

Scope 2: Indirect emissions from the energy a company purchases for its operations.

Scope 3: All other indirect emissions in the value chain.

Purchasing departments are primarily concerned with Scope 3.1 (Purchased Goods and Services), as listed below, but they will also be involved in Scope 1 if fossil fuels are purchased. The following table has details for each scope.

![]() Paulo_Moretti_Scope_Definition.pdf

Paulo_Moretti_Scope_Definition.pdf

Calculations and Challenges

Calculating CO2e for each scope can be complex due to the need to define boundaries between suppliers, one’s company, and one’s customers, as well as determining where to account for each emission. It also requires deciding on the appropriate data sources to use.

There are different calculation methods, and they are evolving. Each methodology varies based on its focus (corporate vs. product-specific, national vs. organizational) and its complexity.

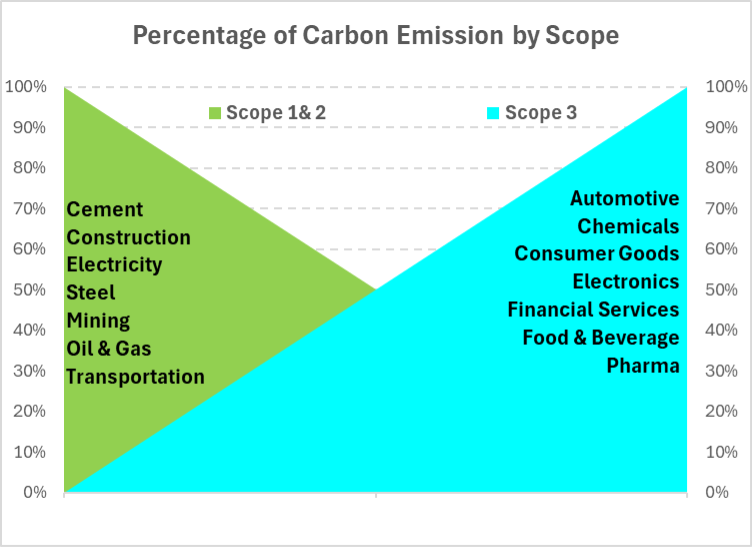

Each company has a different profile when reporting Corporate Emissions. For example, Rio Tinto (mining) reported that 95% of their emissions were Scopes 1&2, while Shell (oil and gas) reported 97%. In contrast, companies like BASF (chemical) and HP (electronics) reported that Scope 3 emissions constituted 84% and 99% of their total emissions, respectively. Based on the USA data for the industries listed below, there is one company with high emissions in Scopes 1&2 and four companies with high emissions in Scope 3.

See below the percentage of emissions between Scopes 1&2 and Scope 3 by industry.

Using Greenhouse Gas Protocol standards and tools, companies must design their product and service value chains. Secondary data sources such as Ecoinvent, SimaPro, CDP, and CoolClimate Network provide average CO2e values for various products and services. This exercise helps identify significant emissions, guiding the focus on obtaining primary data from suppliers and internal operations.

For instance, the CO2e emission rates for electricity vary by location: Alaska (1.05/lb kWh), California (0.49/lb kWh), the UK (0.20/lb kWh), and Brazil (0.04/lb kWh), for example. Primary data, such as CO2e from on-site steam generation, offers precise emission values. Another example, the CO2e for caustic soda production varies: 1.5–2.5 kg CO2e/kg for the mercury cell process and 0.6–1.5 kg CO2e/kg for the membrane cell process, depending on energy sources.

Currently, many companies and their suppliers lack precise CO2e calculations and rely on secondary data. As this data becomes more available, purchasing functions will increasingly incorporate it.

Purchasing Implications

Spend Data

As companies integrate carbon footprint considerations into their sustainability goals, purchasing departments will be tasked with providing detailed spend data. This will necessitate database cleanup to ensure consistency in product and supplier names.

Suppliers

Supplier qualification processes will increasingly require certification that suppliers align with carbon footprint initiatives. Certification bodies may include Ecovadis, SBTi, The Carbon Trust, or PAS 2060.

Purchasing departments will begin requesting CO2e data for products and services, which will be used to compare suppliers based on their carbon emission impact.

For example, Dow Chemical’s net-zero carbon emission ethylene cracker and Polyethylene complex in Alberta, Canada, offers lower CO2e for polyethylene compared to other producers.

Sourcing projects will now include CO2e content analysis alongside price and commercial conditions.

Price Negotiation

This will become a more complex exercise because purchasing officers will need to consider the new price, the CO2e content of each product, and how their company is positioned in relation to current emissions levels, objectives to reduce emissions, and if the company needs to buy CO2e allowances to attend the goals.

Nobody knows yet how the price of low CO2e content products will be priced. However, I’m certain it will be higher than current prices in order to cover the capital investments to produce net-zero carbon emission products.

If suppliers have extra allowances available, they could offer this allowance to offset their price.

Bio-based products will be more competitive with Crude Oil derivatives when CO2e content is considered. For example, Polyol produced from Propylene Oxide has a higher CO2e content than Polyol made from Castor Oil.

Conclusion

Carbon footprint considerations will inevitably impact the purchasing function. It is only a matter of time before it becomes an integral part of procurement strategies.

Acknowledgement

I would like to thank my friend Andre Argenton, PhD, who is Chief Sustainability Officer for Dow Chemical for his technical review and insights. Obrigado.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.