Chemicals & Plastics - Overcapacity

Approaching the mid-point of 2025, the Chemicals & Plastics (C&P) industry is facing a perfect storm. Widespread overcapacity, waning demand, and escalating trade tensions are reshaping the global landscape. According to Independent Commodity Intelligence Services (ICIS), structural imbalances and geopolitical disruptions are converging to exert downward pressure on prices and margins across the value chain. This report outlines key data insights and strategic implications for industry stakeholders.

Industry Overview

Recent data highlight a significant global oversupply in the C&P sector. The aggregate supply-demand balance spans 176 products, amounting for 8.2 billion metric tons (MT) of global capacity and generating approximately USD 4.5 trillion in revenue in 2023. This represents 65% of the global chemical industry, according to Statista, thus offering a strong proxy for industry-wide dynamics.

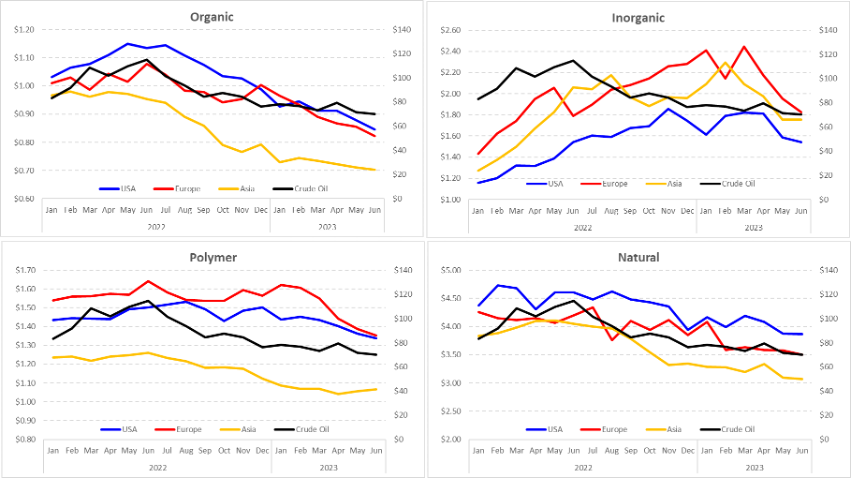

The analysis here incorporates pricing data from Intratec, which reports monthly import/export prices by country. While these figures typically fall below domestic market prices, they serve as reliable indicators of month-to-month market shifts.

Capacity Distribution

In 2023, global chemicals capacity reached approximately 7.5 billion MT, with the Asia-Pacific region accounting for the largest share (48%), as illustrated in Chart 1. Plastics capacity was approximately 558 million MT, with Asia-Pacific again leading at 60%. Note the difference in magnitude between chemical and plastic capacities.

Chart 1

Looking ahead to 2028, ICIS projections based on announced expansions over the past four years suggest continued capacity increases. However, many of these projects are now delayed, and a number of companies have announced plant shutdowns or idling, signaling a market correction underway.

Plant Closures

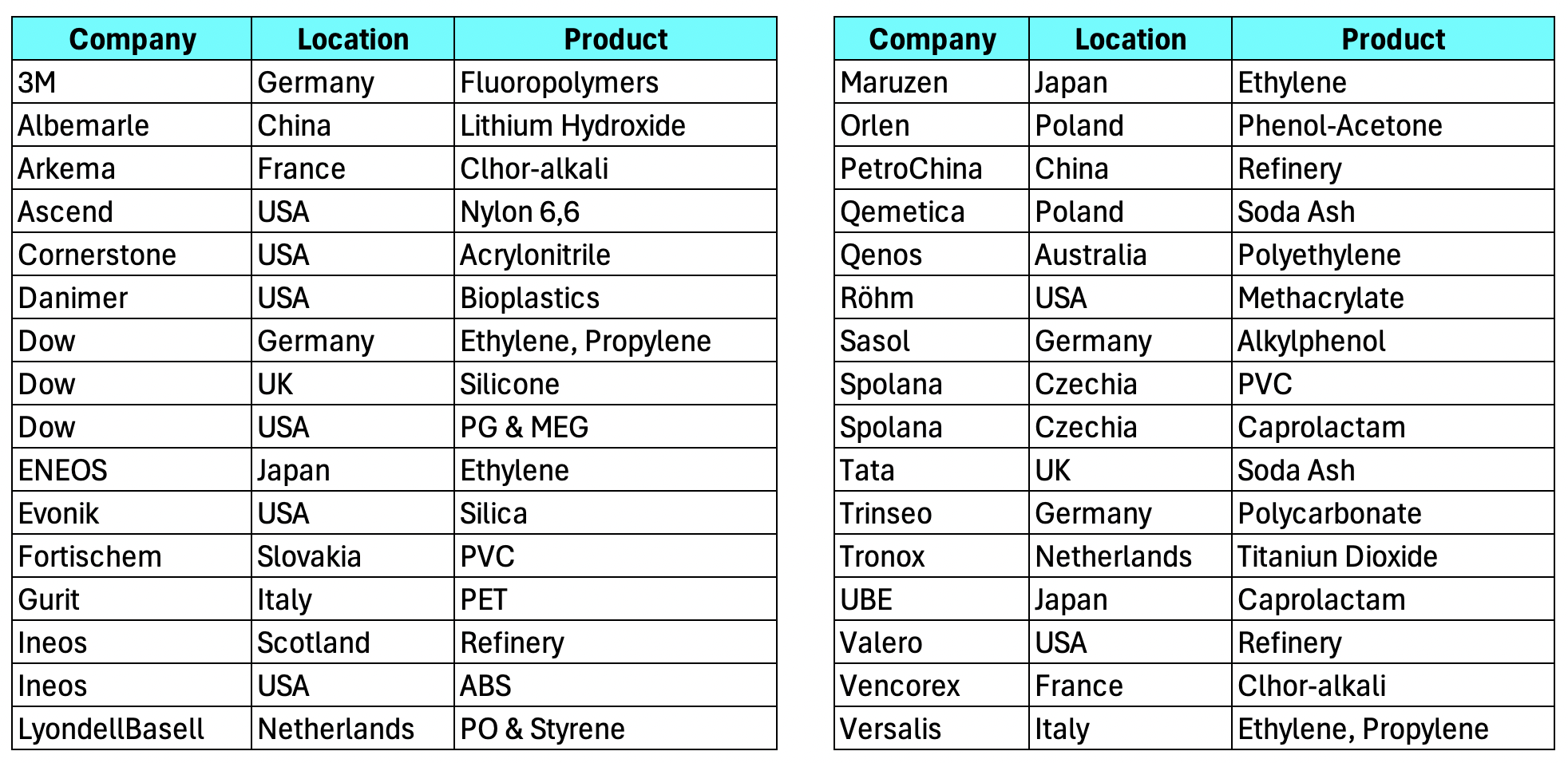

As of early 2025, numerous companies have disclosed plant closures or idle capacity, as detailed in Table 1. These actions validate the presence of overcapacity and suggest an industry-wide move to rebalance operating rates and improve profitability.

Table 1

Pricing Trends

Intratec price data from January to April 2025—compared to the full year of 2024—reveal an average price decline across most regions and categories, with the exception of U.S. inorganics.

Chart 2

Category Highlights:

Inorganics: Of the 66 products tracked, prices declined by 53%. U.S. sulfur prices, however, bucked this trend with a 60% increase. This was driven by severe winter logistics issues, tariff impacts, robust agrochemical demand, and refinery maintenance constraints.

Organics: Of the 96 products in this category, 72% saw price declines, largely due to falling crude oil prices. Notable exceptions include Methylene Chloride, Tetrahydrofuran, and Butadiene.

Polymers: Of the 39 polymer products, 73% experienced price declines, again influenced by lower oil prices. Of note, price increases were observed for PVC scrap, Paraformaldehyde (PFA), and Polycarbonate.

Metals: 68% of 29 products declined, driven by oversupply in lead, zinc, and nickel, and weaker copper demand. A notable exception, cobalt showed a price increase.

Energy: Of 12 tracked products, 85% dropped in price, with Natural Gas as the key exception. This was analyzed in my article, “Commodity Prices – 2024 & 2025 Outlook.”

Strategic Implications

As highlighted by ICIS, Oxford Economics forecasts a shallow global industrial recession in 2025, compounded by tariff disputes. U.S. industrial output is projected to contract by 0.9% in 2025 and 1% in 2026, with a 15% reduction in U.S. imports expected to dampen global demand.

The current mix of overcapacity, trade policy shifts, and global economic uncertainty creates a volatile pricing environment. While the net direction remains unpredictable, this volatility presents opportunities for procurement professionals to add strategic value.

Purchasing teams must therefore:

- Proactively seek alternative sources in low-tariff regions

- Negotiate local price adjustments

- Collaborate with supply chain teams to mitigate logistical bottlenecks

- Drive cost savings and demonstrate measurable value to the business

This is a pivotal moment for procurement to lead. The time is now for buyers to step up and steer their organizations through uncertainty with insight and agility.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.