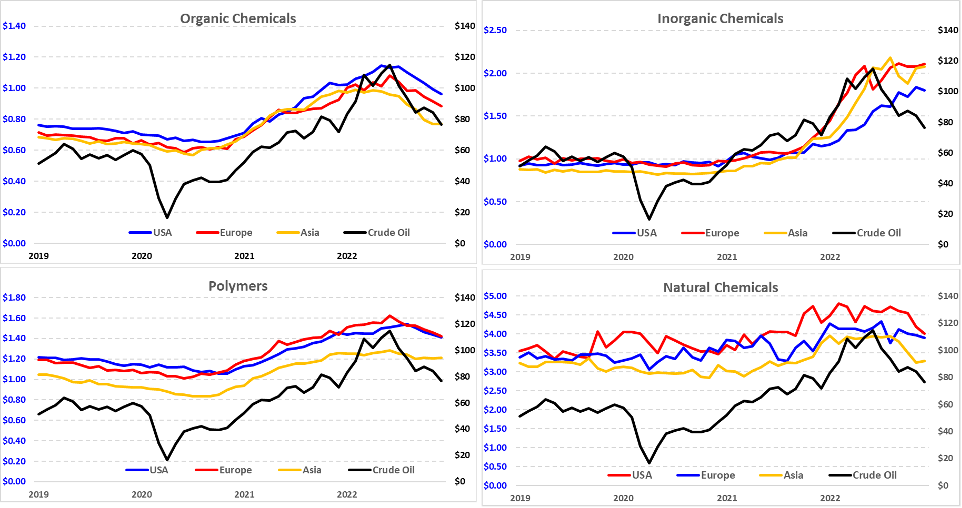

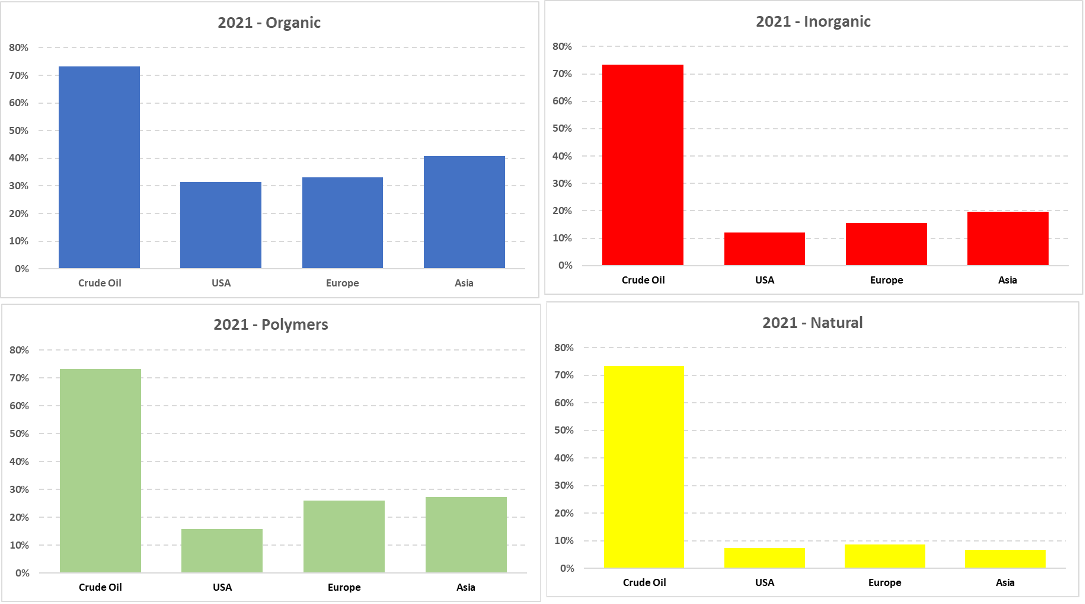

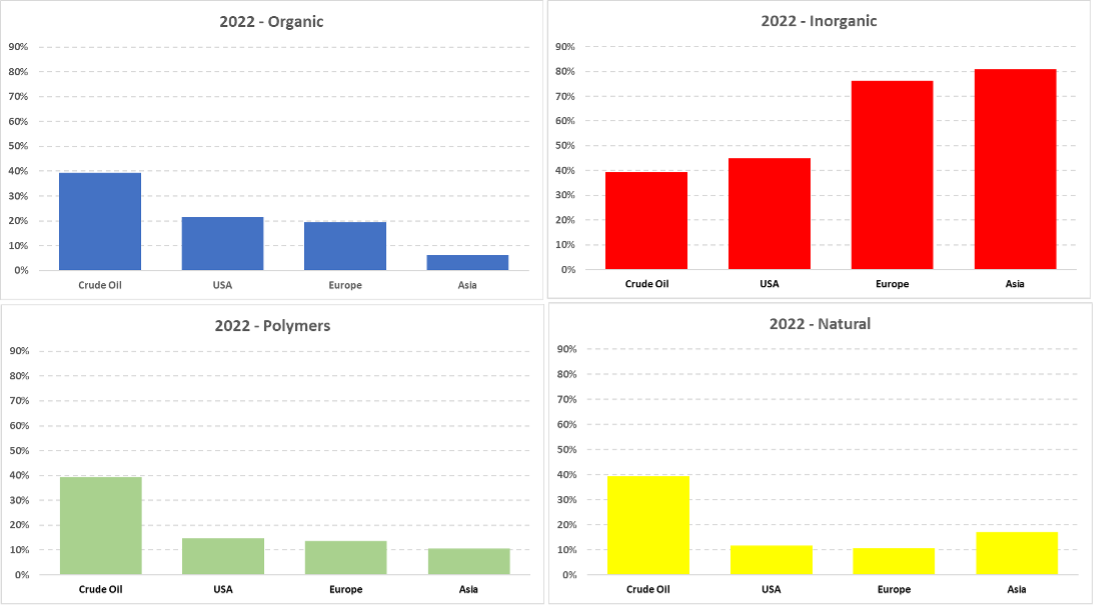

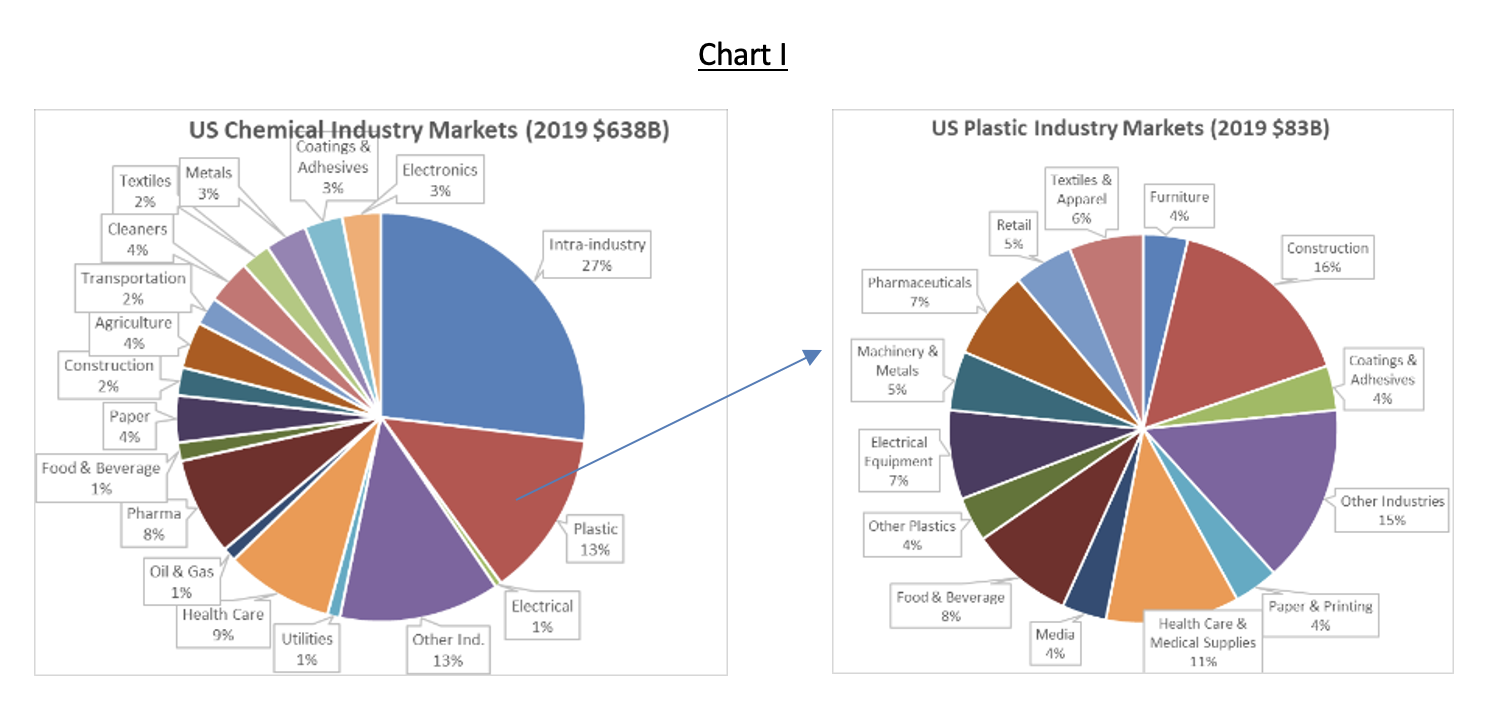

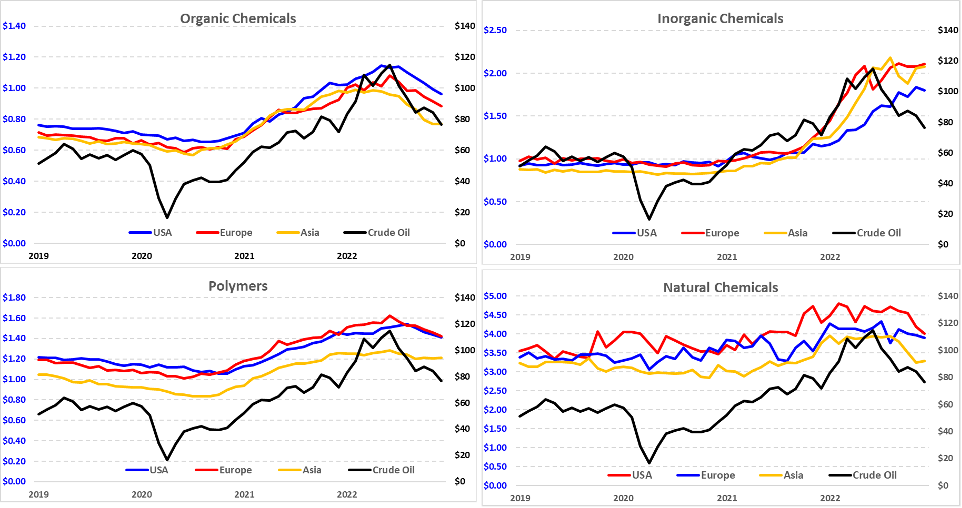

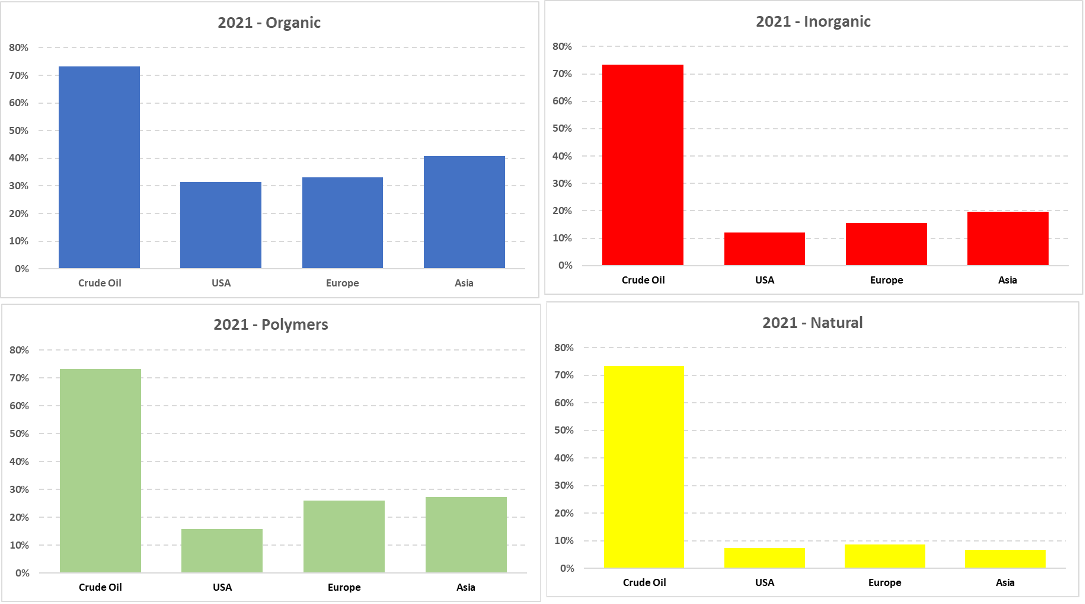

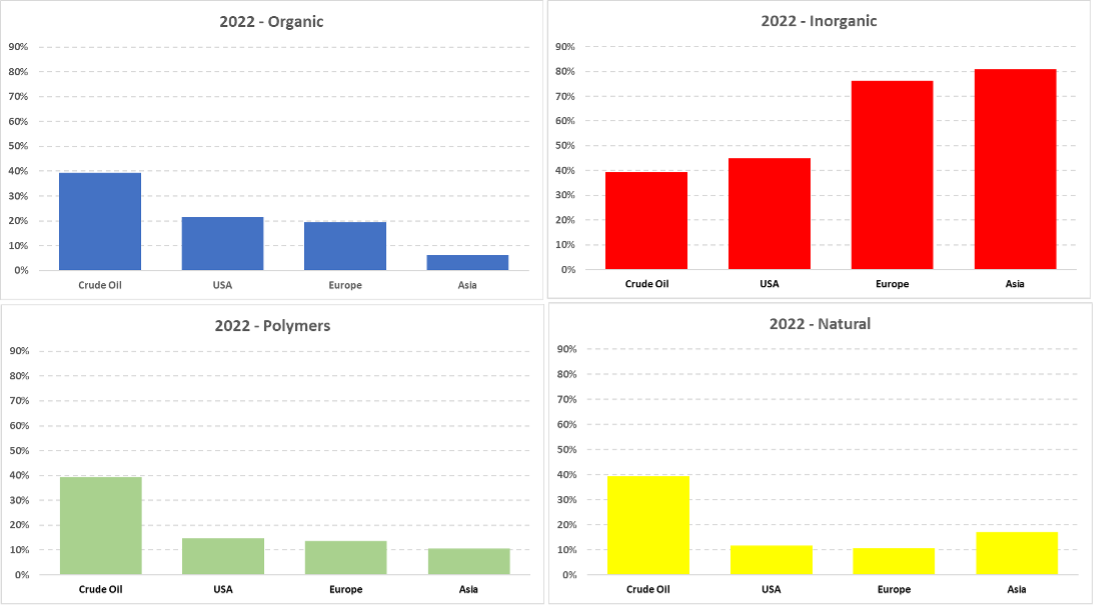

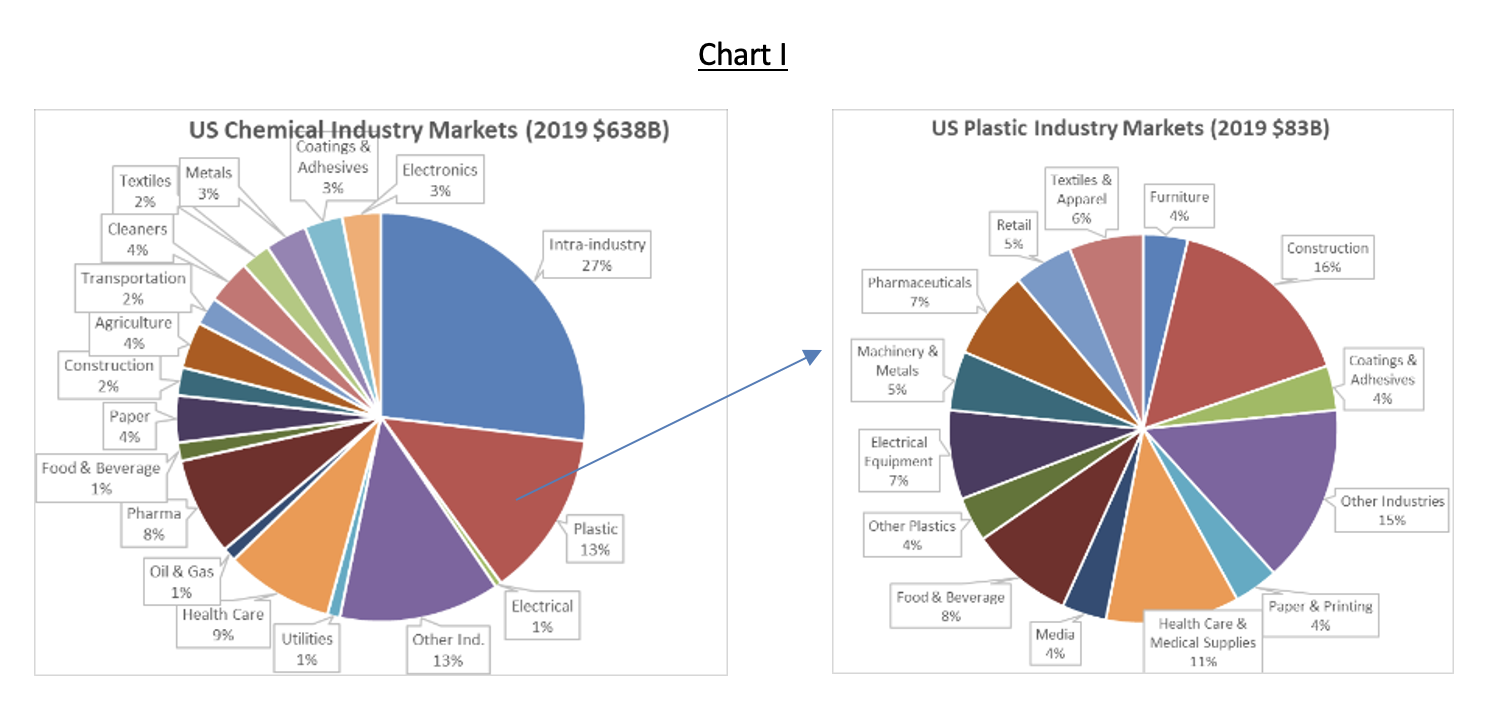

Chemical & Polymer (C&P) prices are volatile due to supply/demand balance and feedstock prices like Crude Oil and Natural Gas, and, most certainly, specific events like the pandemic and geopol...

Chemical & Polymer (C&P) prices are volatile due to supply/demand balance and feedstock prices like Crude Oil and Natural Gas, and, most certainly, specific events like the pandemic and geopol...

Editor's note: In July of 2022, Wen Xie, a Patent Attorney, joined me for an episode of Dial P for Procurement that considered whether the World Trade Organization's decision to waive COVID-19 patents...

One of the aspects of ever-growing experience is the sorrow of knowledge. In times of economic turbulence, procurement could be dragged into a cycle of faulty practices that starts well before the cri...

This content was posted on the ATSC Blog on November 23, 2020 Like everything else in 2020, we can expect the holiday shopping season to come with unique challenges. Not only are pandemic shutdowns on...

This content was posted on the All Things Supply Chain blog on September 28, 2020 Back in the late winter / early fall of 2020, the whole world became intimately familiar with the detailed innerworkin...

This content was posted on the ATSC blog on August 24, 2020 On August 4th, 2,750 tonnes of ammonium nitrate – equivalent to approximately 6 million pounds – that were being stored in a facility at Bei...

This content was published on the ATSC Blog on July 27, 2020 Since risk is a reality in business, and ‘certainty’ is an extremely expensive proposition, an enterprise’s appetite for risk has always be...

This content was posted on the Thinkers 360 Blog on June 13, 2020 What are your predictions for COVID-19 in terms of business and technology implications and recommendations for executives over the ne...

This content was published on the ATSC blog on May 25, 2020 The word ‘chain’ evokes images of metal links locked together, but this analogy has not been apt for a long time. Terms such as network, eco...

This content was published on the ATSC blog on April 20, 2020 Seemingly overnight, every procurement professional’s top priority has become helping their company get through the COVID-19 pandemic and ...

This content was published on the Fairmarkit blog on April 20, 2020 If there is one thing you get used to when you work in procurement, it is that no one outside of the field has any idea what we do f...

This content was posted on the ATSC blog on February 24, 2020 Acute awareness of China’s impact on global business has been front and center since the onset of the Coronavirus health emergency in late...

“When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore-we win big. It’s easy!” – President Donald Trump on Twitter, March 9, 2019.

“Efficient, effective, risk-centric, and risk-adjusted third party lifecycle and risk management is a new and distinct way of doing business. How your company approaches any major change like this one...

Globalization has transformed the world into one big economy. Capitalist theory suggests that markets in an open and healthy economy promote widespread well-being by increasing competition and ensurin...

“When considering any contribution that risk management can make to the organization, it is important to decide whether the contribution will relate to strategy, projects and/or operations. The decisi...

These webinar notes are based on an April 26th webinar presented by Resilinc and Hogan Lovells and hosted by Supply & Demand Chain Executive Magazine. Here is the link to the on demand registration page.

As I mentioned in my weekly webinar recommendations post, I trusted S&DCE as the host of this event because I’ve seen them cover equally ‘hot button’ topics with balance and a high degree of professionalism in the past. This event was no different – in fact, Resilinc CEO & Founder Bindiya Vakil opened the webinar by making the comment that the topic would be handled as a business issue – not a political one.

In August 2017, Hurricane Harvey struck a significant blow to the Houston, Texas metro area, home to the sixth largest import terminal in the world as well as all of the shipping lanes in the Gulf Coa...

Before examining Hurricane Maria’s stampede through Puerto Rico, let’s take a glimpse of this Caribbean island before the natural disaster hit. 3.4 million U.S. citizens live in this commonwealth of t...

“In the new global era, speed and velocity are more important than everything else!” (p. 12) The LIVING Supply Chain: The Evolving Imperative of Operating in Real Time by Rob Handfield and Tom Linton ...