Commodity Prices – 2024 & Outlook

In January, my article “Chemical & Plastics Prices – 2023 & Outlook” expressed the view that chemicals and plastics prices would decrease this year. Six months later, it looks like I was right. In that same article, Wall Street forecasted that crude oil would decrease, which actually did not happen. In the first half of 2024, all commodities decreased in price compared to 2023 except for crude oil.

Methodology

For this current analysis, I have used price data from Intratec, which publishes monthly import/export prices by country. Even though import/export prices tend to be lower than the market, they remain good reference points because they reflect changes in the market on a monthly basis.

This article reflects on changes in price from 2023 through the first half of 2024 in the USA, Europe, and Asia in four areas:

- Organic chemicals: 85 products (acetone, acrylonitrile, benzene, cumene, and others)

- Inorganic chemicals: 54 products (caustic soda, carbonates, sulfates, phosphates, and others)

- Polymers: 35 products (ABS, PET, PE, PP, and others)

- Metals: 31 products (aluminum, copper, carbon and stainless steel, and others)

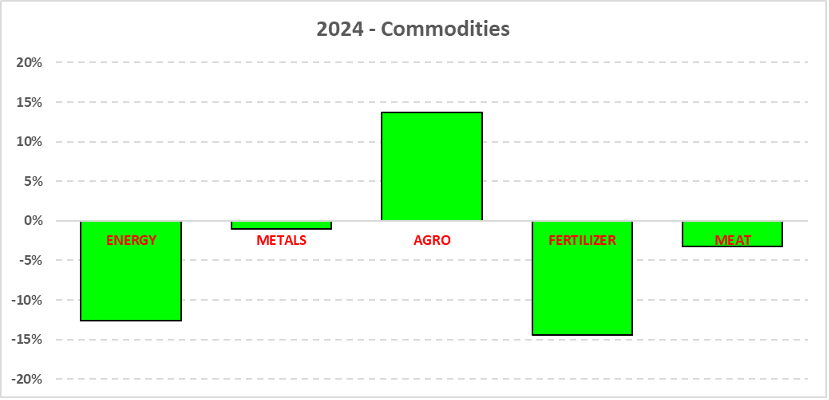

Global Commodities

Based on data published by World Bank Commodity Price Data (The Pink Sheet), I observed that all commodities declined in the first half of 2024 compared to 2023, except for agricultural. In Agro, 54% of 39 commodities showed a price decrease. However, cocoa, coffee, and 16 other commodities saw a sharp price increase, pushing the average to the positive side.

Energy is composed of crude oil, natural gas, and coal. Metals include aluminum, copper, iron, lead, nickel, tin, and zinc. Agro contains 39 commodities. Fertilizers include DAP, TSP, urea, phosphate rock, and potassium dhloride. Meats are composed of fish, beef, chicken, and lamb.

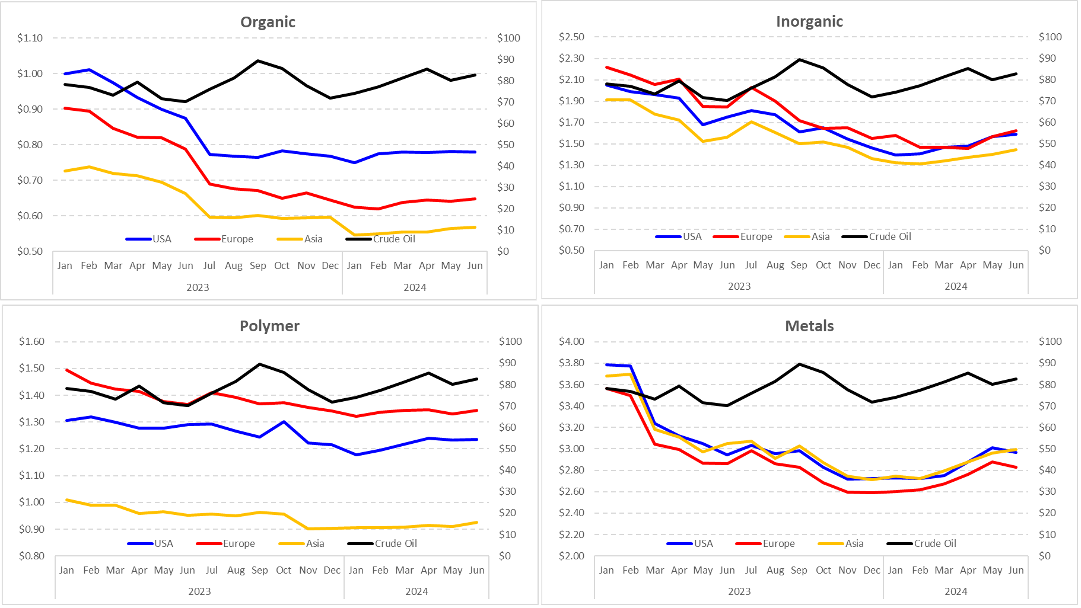

Price Movement

For the price evolution of raw materials, the graphs below show values by region on the left axis. You will observe the comparison price overlay of crude oil (in black) with dollar values on the right axis.

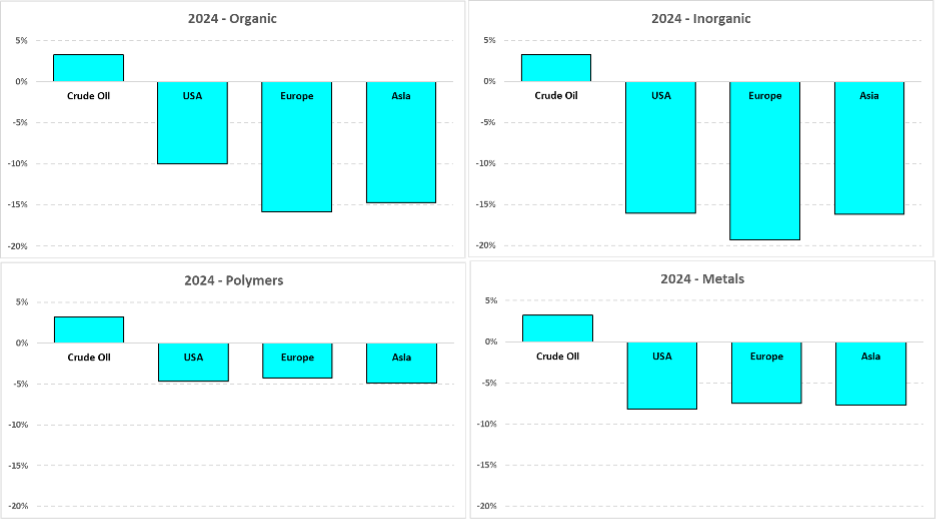

2024 Prices

Because the above line graphs present some difficulty in comparing prices, I include the following bar graphs in percentages to analyze the average prices of the first half of 2024 compared to 2023.

Crude oil experienced an increase of US$2/BBL in the first half of 2024 compared to 2023.

Organics: 58% of 85 organic products presented price decreases compared to 2023, led by bisphenol A and butanol. Prices increased with MIBK, butadiene, and methanol.

Inorganics: 81% of 54 inorganic products presented the biggest decrease compared to 2023 prices, led by lithium derivatives and hypochlorite. Prices increased with superphosphate, sulfuric acid and calcium carbide.

Polymers: 65% of 35 polymers presented price decreases compared to 2023, led by PBT and nylon 66. Prices increased with butyl rubber, cellulose acetate and polycarbonate.

Metals: 68% of 31 metal products presented price decreases compared to 2023 prices, led by palladium and stainless steel coil. Prices increased with silver, copper scrap, and aluminum scrap.

2024 Outlook

Looking at four different sources, there are important predictions we can make for chemicals and plastics for 2024.

- The U.S. Energy Information Administration (EIA) said, “We expect oil prices will increase from an average of $82/b in June to $89/b for the remainder of 2024 and $91/b in 1Q25. Total oil inventories in the OECD remain near the lower bound of their recent five-year range (2019–2023).”

- JP Morgan’s Purchasing Manager Index (PMI) shows a continuous increase reaching above 50 index points, indicating an expanding economy.

- From the BASF report: “In advanced economies, chemical production is anticipated to see a modest growth of 0.8% in 2024, compared to a significant decline of 4.9% in 2023.”

- According to Fitch Ratings, utilization rates in the global chemical industry are expected to remain low in 2024, especially for commodity producers.

Interestingly, we note that BASF forecasts production growth and Fitch Ratings says the utilization rates will remain low, but still showing recovery from 2023. Also, based on the price increase of crude oil, I expect some price increases in organics and polymers for the second half of 2024. Based on the line graphs above, we can see that metals and inorganics are trending to price recovery, indicating some increases in the second half of 2024.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.