Pandemic Impact on Prices – Chemicals & Plastics

The current public health crisis due to COVID-19 has impacted not only people’s lives but also businesses around the globe. The demand in most sectors has shrunk, and with supply and demand unbalanced, the price of most products has been affected. With less demand, most products have seen price decreases, but there are exceptions.

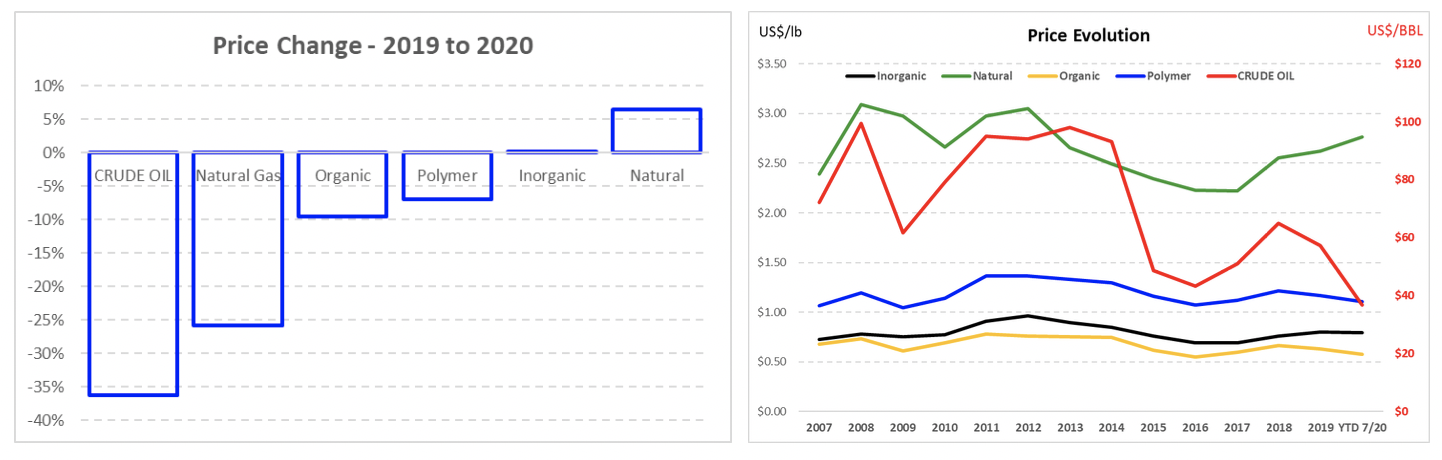

In the Chemicals & Plastics (C&P) space, we saw the same impact starting with Crude Oil and Natural Gas, where the average price in 2020 dropped from 2019 as 36.2% and 25.8%, respectively.

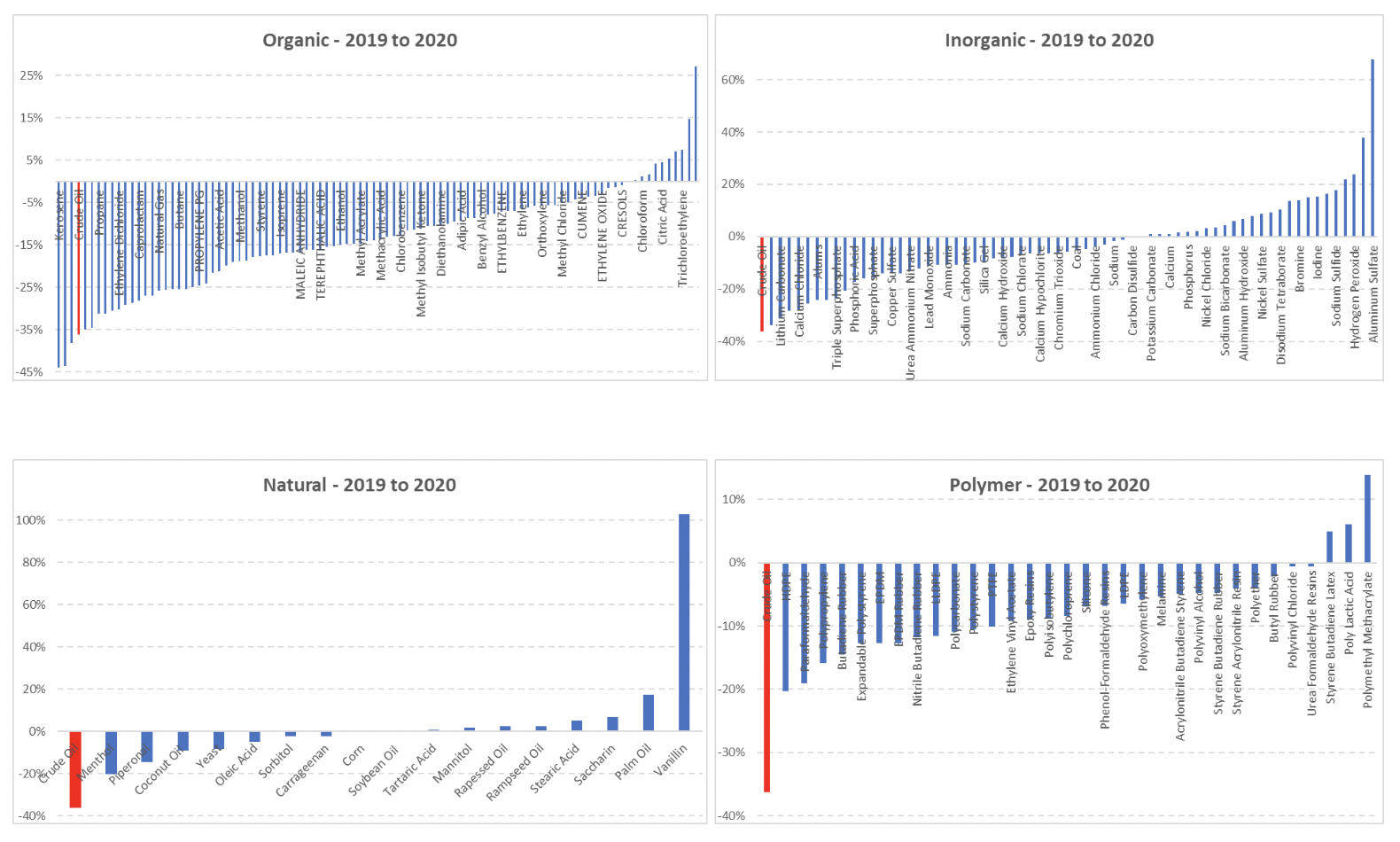

In this article, we analyze the price change in the USA from 2019 to 2020 for Organics (94 products), Inorganics (66), Polymers (32), and Natural Derivatives (17). In order to avoid specific changes due to seasonality, we calculated the average price from January 2019 to July 2019 versus the average from January 2020 to July 2020 in the USA.

USA Manufacturing

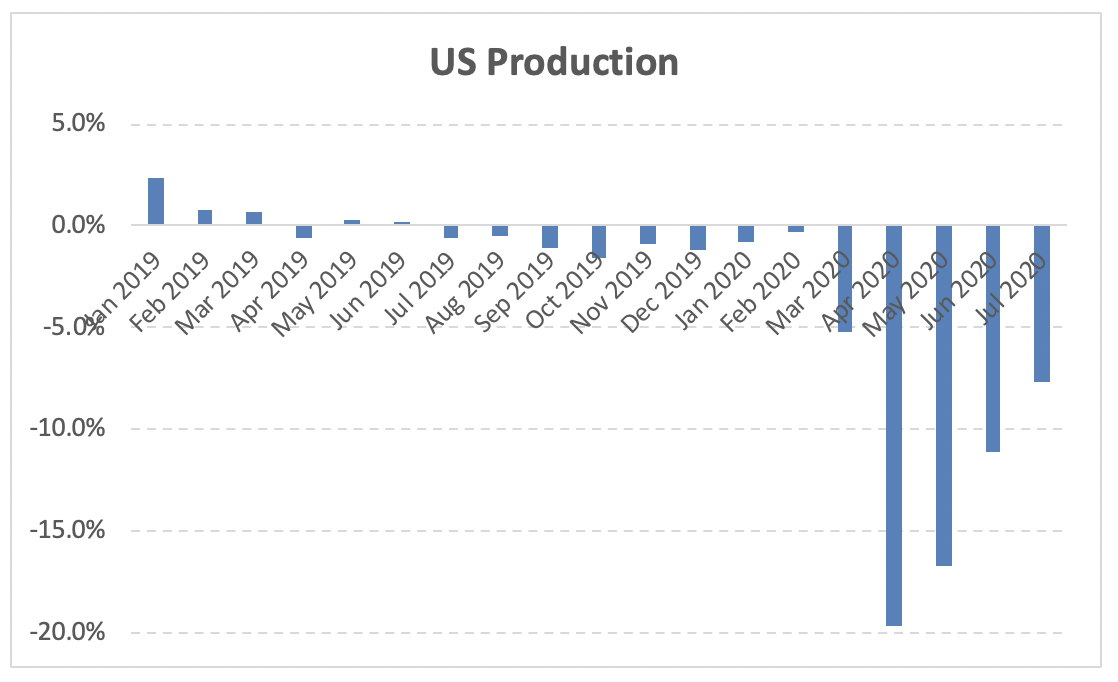

As we are analyzing the prices in the USA, we collected the production data from 2019 to 2020 shown below:

The pandemic effect started in March with a lowered production of –5.2%, falling to the worst month in April at –19.7%, then starting to recover at –7.7% in July 2020.

Price Changes

As noted above, the first C&P products impacted were Crude Oil and Natural Gas, with price decreases of 36.2% and 25.8%, respectively, which affects most derivatives. All products used against COVID – such as sanitizer chemicals or materials to produce ventilators, gloves, masks, and shields – had price increases because of sudden huge demand. For example, the price of Isopropyl Alcohol used to produce hand sanitizer moved from US$ 0.45/lb in February to US$ 1.05/lb at the end of March.

We calculated the average price change for each product and then aggregated into average changes for Organics (94 products), Inorganics (66), Polymers (32), and Natural Derivatives (17).

As expected, the price decrease in Organics was most affected (–9.5%) because they are the first derivatives from Crude, Gas, or both. The impact on Polymers (–7.0%) is understandable because most of them come from Organics.

Most surprising for me was the aggregate average for Inorganics at 0% decrease and Natural Derivatives with an aggregate price increase of 6.4%. The graphs below show the changes for each product, where most changes were price decreases, along with price increases as well. (Crude Oil in red in the graphs as a reference).

Excel file with list and graphs attached: ![]() Pandemic_-_Attachment_A_-_Price_change_2019_to_2020.xlsx

Pandemic_-_Attachment_A_-_Price_change_2019_to_2020.xlsx

Purchasing in action

In any crisis, there are threats but also opportunities. The opportunity now is to get some savings for those products presenting price decreases.

If you have a contract in place with prices linked to a market index or formula pricing, you are protected and enjoying the savings (or avoidances). There are Market indexes based on Contract and Spot: if the market index or formula pricing is related to the Contract index, you need to compare to a Spot basis because, in most cases, Spot pricing is lower than Contract pricing.

If you have agreements with suppliers for a quarterly price adjustment, it is time to change to a monthly basis to enjoy savings because of the price drop.

Some experts are saying that the manufacturing sector will take from 6 to 12 months to recover. With that perspective, I believe the prices will take the same time to recover to 2019 levels, so purchasing must take action to get the savings.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.